Experience the Convenience

Triangle Credit Union has created the perfect combination of ways to help you manage your finances quickly, conveniently, and safely.

By offering industry leading technologies like Online & Mobile Banking, Interactive Teller Machine (ITM), and 24/7 Member Support, we are confident that your banking experience will be a pleasant one from home or wherever your adventures take you.

The Next Generation of TCU Digital Banking is Here!

Access all the features you need with ease– no more buried navigation items. Plus, customize your homepage to your preferences and financial goals.

Read our blog for more information and to see side-by-side screenshots of the “before” and “after” pictures to ease your transition into an enhanced online banking experience.

Convenient Banking is Here!

With our free 24/7 Online & Mobile Banking, members can bank at their convenience, wherever they want—at home, at work, or on the go.

Online banking requires a computer and an internet connection – tools you probably already have!

We offer many of the services you’ve come to expect from financial institutions including:

- Account Transfers

- Person-to-Person Payments

- External Transfers

- Bill Pay

- Remote Deposit

- Goal Builder

- Personal Finance

- TCU Card Management

- Money Management

- Open New Accounts

- Apply for Credit Cards & Loans

- Check Reordering

- eStatements

Sign into your account online or download our mobile app to get banking!

To request the deletion of your mobile banking account, click here.

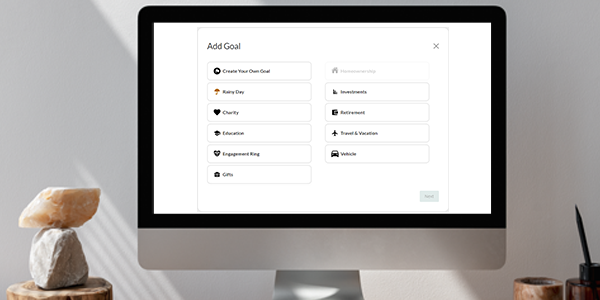

Keep Your Savings Goals on Track with Goal Builder

- Set up your goals: Select from 10 goal categories or create your own

- Assign Money: Set up one-time designations or automatic, recurring allocations

- Track progress: View and manage your goals in one place

- Improve your financial health: Watch your money grow

Hi-Tech with a Personal Touch

Interactive Teller Machine (ITM) provides more functionality and features that are not available with a traditional ATM. With an ITM, if you need assistance, you can access support via live video, just as if you were standing in front of a teller.

You can do anything you could typically do inside a branch at the ITM, such as:

- Order and cash checks

- Make deposits

- Withdraw cash

- Make loan payments

Our live support is available during our normal business hours, then the ITM functions as a traditional ATM after business hours.

Triangle Credit Union’s Payment Portal is Here!

LoanPay allows you to easily make one-time payments or schedule automatic payments through online or mobile browsers with your debit card or checking account.

Try LoanPay Today!Direct Support within Online & Mobile Banking

Whether you are home or on the road, connect instantly with us via Live Chat through Online or Mobile Banking.

When you need support, log on and click Chat Now to connect with a friendly, knowledgeable representative. Our representatives are available during business hours to help you with your financial needs.

Support When You Need It

We offer members support 24 hours a day/ 7 days a week, including weekends and holidays!

Call us to help you with:

- Accessing online accounts

- Internal transfers and payments

- Initiating stop-payments

- Lost or stolen debit cards

Call (603) 889-2470 or (800) 276-2470